How To Report Partnership Income On 1040

Form 1040- income tax return guide 1065 form return partnership income fill How to file taxes for an llc (step-by-step)

Learn How to Fill the Form 1065 Return of Partnership Income - YouTube

Irs 1040 templateroller fillable proprietorship Form 1040, schedule e-supplemental income and loss 1040 profit income employment individuals

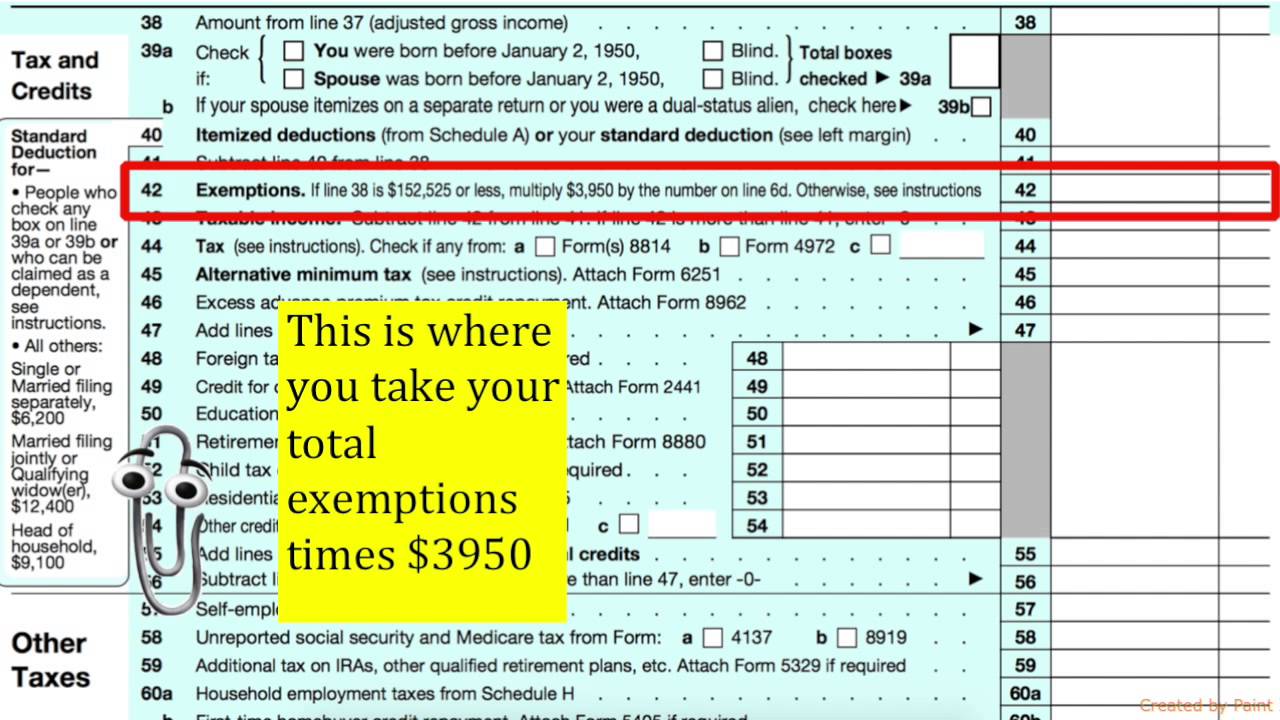

Tax 1040 income form return guide

1040 sr irs tax pdffiller fillable signnow refund mageneIncome schedule adjustments additional Schedule irs deductions beneficiary creditsSchedule 1 additional income and adjustments to income.

Schedule income 1040 loss form supplementalLearn how to fill the form 1065 return of partnership income Schedule c 1040 line 31 self employed tax magi instructions home officeIrs fillable form 1040 / irs 1040.

Schedule k-1: partner’s share of income, deductions, credits, etc.

Irs 1040 sr 2020-2024 form .

.

Form 1040, Schedule E-Supplemental Income and Loss

Learn How to Fill the Form 1065 Return of Partnership Income - YouTube

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K-1: Partner’s Share of Income, Deductions, Credits, etc.

Irs 1040 Sr 2020-2024 Form - Fill Out and Sign Printable PDF Template

Irs Fillable Form 1040 / IRS 1040 - Schedule 8812 2020 - Fill out Tax

Form 1040- Income Tax Return Guide - YouTube

Schedule 1 Additional Income and Adjustments to Income - YouTube